Support your customers, employees and Contact Center agents with Conversational and Generative AI.

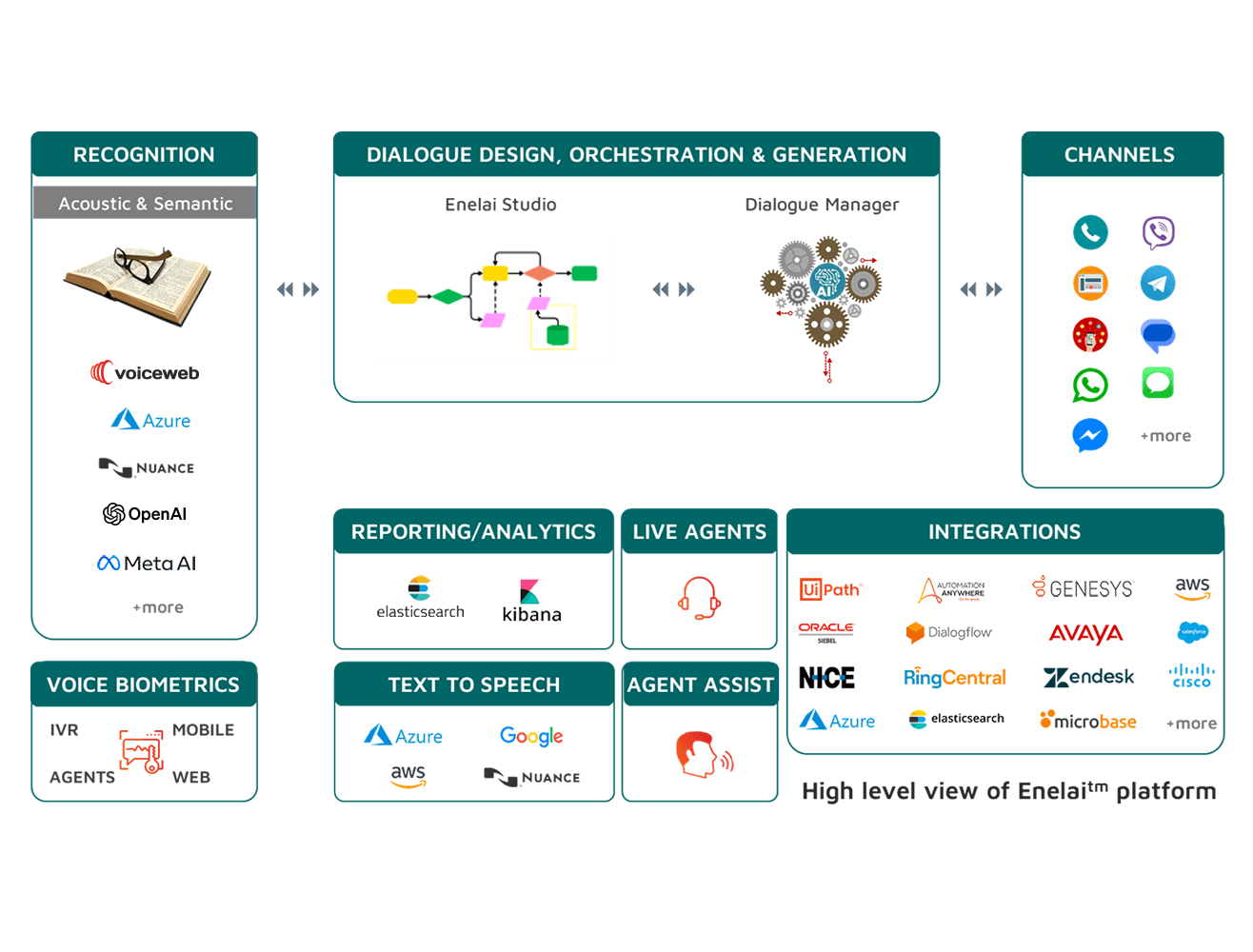

Voiceweb enelaitm platform utilizes artificial intelligence (AI), Machine Learning and Natural Language Understanding (NLU) to complete the users’ requests, answer their questions or to suggest the best responses to your agents.

Support your customers, employees and Contact Center agents with Conversational and Generative AI.

AI Virtual Assistants (chatbots)

Conversational IVR

Agent Assist

Voice Biometrics

Speech Recognition

Generative AI

AI Virtual Assistants (chatbots)

with text and/or voice entry for highest self-service rates (typically 88% - 95%).

Conversational IVR

for high IVR self-service (>55%), reduced OPEX and correct routing of all inbound calls.

Agent Assist

with Generative AI (GPT models) for suggesting the best-possible responses to contact center agents during their calls and chats.

Voice Biometrics

for accurate and fast authentication of the users during Agent calls, or in IVR self-service or in chatbots: with only 3 seconds of speech and >92% completion.

Speech Recognition

for IVR calls, chatbots, agent calls (transcription for analytics) and any audio transcription requirement of a contact center or an Enterprise with accuracy up to 95% (5% WER).

Generative AI

Utilizing GPT Large Language Models for greatly improved Customer Experience in chatbots and powerful Agent Assist. With emphasis on personal data protection (PII) and data privacy.

Businesses have been adopting enelaitm AI-powered platform to:

answer frequent questions of consumers (FAQs)

automate Customer Service tasks (self-service)

provide assistance to their Agents while discussing with customers

gather information from consumers e.g. for KYC, lead generation or lead qualification

sell / upsell products and services

enhance the consumers’ shopping experiences

deliver personalized offers & notifications to customers

deliver content and VAS to consumers

enable users to book appointments

provide HR information and documents to employees

provide IT Helpdesk support

generate Contact Center Analytics and Predictive Analytics

Highest Business Results and KPIs

ensuring that all business goals will be fulfilled – and even exceeded.

OPEX

Savings

36%

up to 36%

reduction in contact center operating costs

Chatbot

Self-Service

95%

up to 95%

from 88% to 95%

self-service

Speech IVR

Self-Service

58%

up to 58%

from 50% to 58%

self-service

Customer Satisfaction

65%

up to 65%

from +60% to +65% NPS and 8.0 to 8.5 CSAT

Speech Recognition

6%

as low as 6%

from 6% to 9% WER

(Word Error Rate)

Voice

Biometrics

92%

up to 92%

of authentications completed in IVR and Agent calls within 3 seconds

Highest Business Results and KPIs

ensuring that all business goals will be fulfilled – and even exceeded.

OPEX

Savings

Chatbot

Self-Service

Speech IVR

Self-Service

Customer Satisfaction

Speech

Recognition

Voice

Biometrics

Millions of conversations being successfully

completed every month!

Over 380 million consumers have had their requests successfully serviced by an automated Virtual Assistant created with enelaitm platform. The insights and feedback collected from each deployment are fed back into enelaitm as new functionalities & capabilities.

Pay only for results!

Clear & concise pricing model ensures OPEX

savings and quick ROI for the Enterprise

Do it yourself or collaborate with our specialists

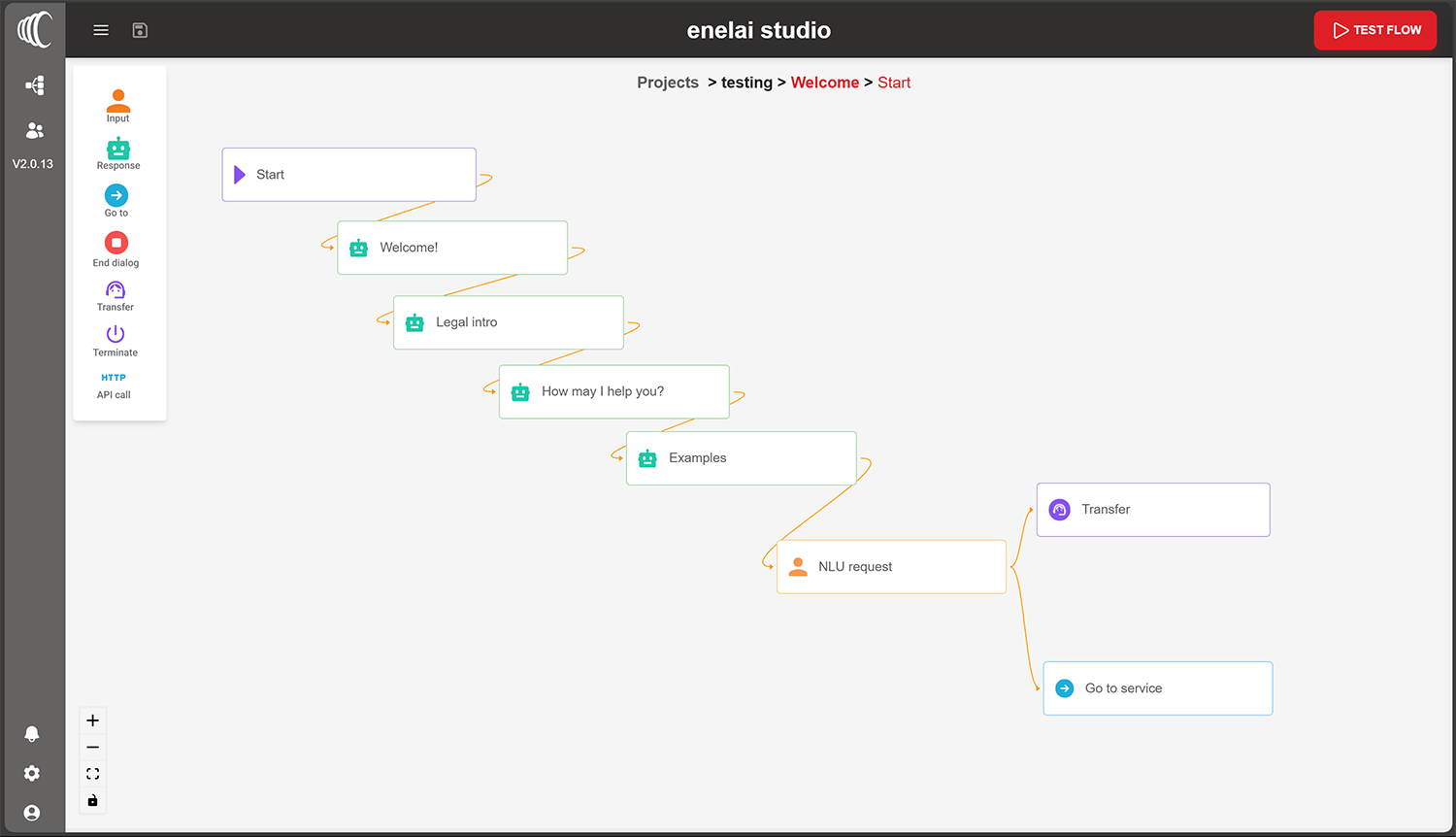

Enelaitm Studio is a No-Code conversation design and collaboration tool packed with features from Voiceweb’s 20+ years of hands-on implementation expertise in developing complex Customer Service projects. Enelaitm Studio offers much more than a typical “bot builder” application allowing designers to easily create any Conversational AI, Voice or Chat-based scenario that may even include complex rules, logic, backend integrations, and more…

Design and implementation services

Voiceweb consultants (and our local partners) work closely with Enterprise client teams -often coming to be thought of more as internal employees rather than external specialists- in order to truly understand each Enterprise's specific business environment and culture, facilitate the free flow of information and ideas, and ultimately deliver a high-quality digital solution that fully meets and exceeds all expectations.

Enterprise-grade platform

Easy integration to the existing infrastructure Enelaitm platform provides pre-built integrations with popular Enterprise software while its versatile architecture allows for almost plug-and-play integration with pre-existing software applications in an Enterprise Contact Center. Meeting Enterprise security and data privacy standards Voiceweb products meet all information security, compliance and payment standards requirements -such as PCI/DSS and GDPR- and have been installed in numerous banks and mobile operators for purchases and financial transactions, after audit and approval from the local Regulators in each country.

Do it yourself or collaborate with our specialists

Enelaitm Studio is a No-Code conversation design and collaboration tool enabling designers to easily create any Conversational AI, Voice or Chat-based scenario that may even include complex rules, logic, integrations to backend applications, and more.

Design and implementation services

Voiceweb consultants (and our local partners) work closely with Enterprise client teams -often coming to be thought of more as internal employees rather than external specialists- in order to deliver a high-quality digital solution that fully meets and exceeds all expectations.

Enterprise-grade platform

Easy integration to the existing infrastructure

Enelaitm platform provides pre-built integrations with popular Enterprise software while its versatile architecture allows for almost plug-and-play integration with pre-existing software applications in an Enterprise.

Meeting Enterprise security and data privacy standards

Voiceweb products meet all information security, compliance and payment standards requirements -such as PCI/DSS and GDPR- and have been installed in numerous banks and mobile operators for purchases and financial transactions, after approval from the local Regulators in each country.